This means volatility in the market is shrinking and a sign the market is likely to breakout, soon. Get $25,000 of virtual funds and prove your skills in real market conditions. No matter your experience level, download our free trading guides and develop your skills. I know all this sounds a bit confusing, so have a look at the image below which illustrates this strategy. If you had placed another entry order below the slope of the higher lows, then you would cancel it as soon as the first order was hit.

Still, traders should remember that these rules don’t guarantee a successful trade. Therefore, many traders modify them to suit their trading approaches. You can use the TickTrader platform to develop your own rules for triangle trading. In the above price chart of EUR/USD currency pair, a reversal symmetrical triangle forms that signals a price reversal from a bullish trend to a bearish trend. Below are visual examples of symmetrical triangle chart patterns. A symmetrical triangle is a chart pattern characterized by two converging trend lines connecting a series of sequential peaks and troughs.

Use it for identification of market direction like market makers do. In the psychology heading, you will learn about the reason behind the formation of a price pattern. Without knowing the real logic, it does not make sense to trade a pattern either in a bullish or bearish direction.

This option gives you a better entry as you can use the opportunity to enter the trade exactly at the retest. On the other hand, its limitation lies in the fact that you may never get the opportunity to enter a trade as the retest isn’t guaranteed to happen. The advantage of the first option is that you can’t miss out on a trade, as you are in as soon as the candle closes above/below the trend line. However, the close may occur far away from the trend line, which means that your take profit window has narrowed, while the amount of pips you are risking has increased.

Price analysis 8/7: SPX, DXY, BTC, ETH, BNB, XRP, ADA, DOGE … – Cointelegraph

Price analysis 8/7: SPX, DXY, BTC, ETH, BNB, XRP, ADA, DOGE ….

Posted: Mon, 07 Aug 2023 20:33:23 GMT [source]

If the price does a pullback, then go long on the break of the highs. If you have followed me for a while, you know I like to use the IF-THEN template to develop my trading strategies. Now, you don’t want to enter right now because the price is “overextended” and your stop loss is wide. Often, the price breaks out of the Symmetrical Triangle and it becomes “overextended”.

Symmetrical Triangle Pattern: A Price Action Trader’s Guide

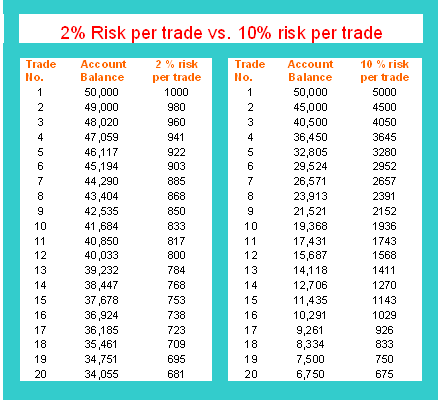

We have no knowledge of the level of money you are trading with or the level of risk you are taking with each trade. HowToTrade.com helps traders of all levels learn how to trade the financial markets. For stop-loss, you’ll be looking to insert an order below the lowest price level of the previous trend. Take profit target should be located at 50%, 61.8%, or 78.6% levels. Adding Fibonacci levels to the chart helps us confirm the breakout and find the correct levels for stop-loss and take-profit orders.

- Conversely if a stock is falling prior to a symmetrical triangle forming, the stock should continue lower.

- It’s a bilateral pattern, meaning it provides buy and sell signals.

- But it is used with the confluence of any other chart pattern to increase the risk-reward ratio.

- On the other hand, its limitation lies in the fact that you may never get the opportunity to enter a trade as the retest isn’t guaranteed to happen.

- In technical analysis, a symmetrical triangle is a tool that traders use to forecast a price direction.

Look at the image below for a better understanding of this triangle pattern concept. The Harami candlestick pattern is usually considered more of a secondary candlestick pattern. These are not as powerful as the formations we went over in our Candlestick Patterns Explained article;…

Bull Flag Trading Pattern Explained

After the upside breakout, it proceeded to surge higher, by around the same vertical distance as the height of the triangle. Since we already know that the price is going to break out, we can just hitch a ride in whatever direction the market moves. The range of price increasingly narrows by making a series of higher lows and lower highs and this is caused by growing indecisiveness in the market. A stop-loss will be placed at the highest level before the triangle was formed (around the 50% Fibonacci level). When the price breaks out of the Symmetrical Triangle, it might re-test the previous market structure. At this point, traders who bought the highs are sitting in the red.

For that matter, a trader must be alert to the previous trend before the pattern is formed. Here’s a bullish symmetrical triangle in Dollar-Yen, there was a trend up into the pattern, it had a good duration, the price breakout was clean. The only note caution of is the breakout occurred after three-quarters of the way along the pattern’s width. This trade did eventually play out but the funding costs to get there would have been significant as it spent most of the year ranging sideways. Hello everyone, if you like the idea, do not forget to support it with a like and follow. Today is LTC’s halving and this might be the sell-the-news event.

Identifying the Real Breakout

Bull flag trading patterns are one of many patterns that traders study in the markets. Trading patterns are a way to simplify the markets and condense information into bullish symmetrical triangle repeatable, visual formations…. The price of this pattern will be determined by its height from the base of the triangle so that its carried over the break point.

Gold Price Forecast: XAU/USD upside appears limited amid triangle breakdown – FXStreet

Gold Price Forecast: XAU/USD upside appears limited amid triangle breakdown.

Posted: Thu, 03 Aug 2023 03:27:39 GMT [source]

In this case, we would set an entry order above the resistance line and below the slope of the higher lows. In the chart above, you can see that the buyers are starting to gain strength because they are making higher lows. Eventually, the area of indecision is resolved and the formation explodes, usually with an increase in volume. One way to tell is to look at the trend of the higher timeframe.

Full Symmetrical Triangle Trading Strategy

It is recommended to hold off for a day after the breakout to determine if the pattern is real or not. Look for a one-day closing price target below the trend line for a bullish signal and above the trend line for a bearish signal. To learn more about stock chart patterns and how to take advantage of technical analysis to the fullest, be sure to check out our entire library of predictable chart patterns. These include comprehensive descriptions and images so that you can recognize important chart patterns scenarios and become a better trader. The symmetrical triangle is a technical analysis chart pattern that represents price consolidation and signals the continuation of the previous trend.

When two trend lines converge with the converging trend lines connecting and containing several peaks and troughs, then this pattern is indicated. A symmetrical triangle is a common chart pattern that appears during an ongoing trend and indicates that the prices are consolidating before moving higher or lower. The pattern is characterized by two converging trendlines, creating a shape of a triangle.

After this target is completed, we will close 50% of the trade. If the trend continues, we will hold the other 50% until the price breaks another swing point on the chart. A triangle chart pattern involves price moving into a tighter and tighter range as time goes by and provides a visual display of a battle between bulls and bears. The symmetrical triangle can be both bullish or bearish, depending on the location of the pattern.

What is the Symmetrical Triangle Candlestick Pattern?

These are the most common pros and cons of trading the symmetrical triangle candlestick pattern. For traders, this is the perfect entry level with a stop loss at the lowest level of the previous ‘bearish’ price swing. If the higher timeframe is in an uptrend, then chances are, the symmetrical triangle would breakout higher. Before trading, filtering the best working conditions will increase the probability of winning in a trade. There are few conditions that are the best working conditions for this chart pattern. Another method to avoid false breakout is by looking for a breakout with a big body candlestick.

Here, in this article, we are going to explain everything you need to know about the symmetrical triangle chart pattern. The symmetrical triangle, which can also be referred to as a coil, usually forms during a trend as a continuation pattern. The pattern contains at least two lower highs and two higher lows. When these points are connected, the lines converge as they are extended and the symmetrical triangle takes shape. You could also think of it as a contracting wedge, wide at the beginning and narrowing over time.

For example, if the aforementioned security breaks out from $12 on high volume, traders will often place a stop-loss just below $12. If the price of a market breaks out of the declining resistance level of the pattern, it is a bullish signal. If the price of the market breaks down below the rising support level of the pattern, it is a bearish signal. Drawing a symmetrical triangle pattern involves combining these components of the converging declining resistance level and the rising support line together.

This is the requirement we need in order to confirm this pattern on the chart. Also, notice that the lower level of the triangle starts later than the upper level. In a real symmetrical triangle on a piece of paper, the two sides need to be equally long. The reason for this is that the stock price is unable to draw a top and a bottom at the exact same time. After all, the x-axis on every stock trading chart refers to time.